Survey: 56 Percent of FBOs Report Increased Fuel Sales in 2019

/Uncertainty, Turbulent Oil Prices Complicate 2020 Forecast

Ed. note—Aviation Business Strategies Group released its survey results toward the beginning of the 2020 NBAA Schedulers & Dispatchers Conference, when this article was published. The week of the conference was pivotal. By the end of the week, concerns about the COVID-19 pandemic began to cause major event cancellations. In fact, the conference concluded earlier than scheduled. As the survey results were prepared and reported, uncertainty prevailed. Business aviation had seen early warning signs but not the true impact of the pandemic.

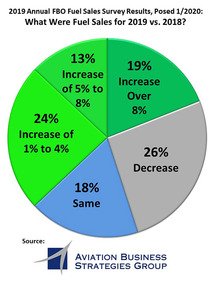

CHARLOTTE, N.C.—Fifty-six percent of U.S. and Canada FBOs surveyed say they sold more fuel in 2019 compared to 2018, according to the annual survey conducted by Aviation Business Strategies Group.

“There’s no question that 2019 proved to be a very upbeat and positive year for the FBO industry,” ABSG principal John Enticknap said. “The survey showed a continued incremental increase in fuel sales for the fourth year in row for the majority of responding FBOs with a healthy 19 percent of FBOs surveyed reporting an increase of more than 8 percent.”

The percentages of FBOs experiencing 8 percent or greater increases and 5 to 8 percent increases were the same as in the previous survey. The share of FBOs that sold 1 to 4 percent more fuel grew by 2 percent, compared to the previous year, to 24 percent.

Such incremental increases in fuel sales are consistent with the increases in flight activity and flight hours reported by ARGUS TRAQPak for 2019, ABSG principal Ron Jackson said.

2020 FBO Industry Forecast

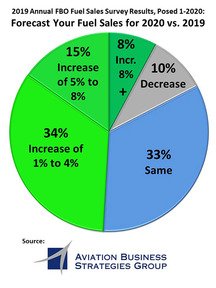

After ABSG posed the survey questions in late January 2020, 65 percent of responding FBOs said they expected greater fuel sales in 2020. Only 10 percent said they expected fuel sales to decrease compared to 2019.

That confidence extended to the full economy, too. More FBOs — a record high of 73 percent, compared to 61 percent a year ago — said they thought the economy is moving in the right direction.

That confidence extended to the full economy, too. More FBOs — a record high of 73 percent, compared to 61 percent a year ago — said they thought the economy is moving in the right direction.

Citing uncertainty about global public health and the economy, ABSG has deferred its independent growth forecast for the industry.

“Our guidance to FBO operators is to stay the course, conduct business as usual, keep an eye on your margins and continue to provide a safe environment while delivering an exceptional customer experience,” ABSG said.

Oil and Jet A Prices and Sustainable Aviation Fuel

ABSG’s forecast says the FBO industry can expect oil prices to be “very turbulent” until the later half of the year, when it expects pricing to stabilize around $50 per barrel. Jet A fuel prices should follow the lead of oil prices, ABSG said.

In the survey, ABSG asked FBOs whether they plan to sell sustainable aviation fuel in 2020. Only 3 percent of FBOs said they would offer SAF. Eighty percent of respondents said, “No.”

SAF “is here to stay,” ABSG said. It advises FBOs to plan to add SAF to inventory as more aircraft operators adopt the alternative fuel.

SAF “is here to stay,” ABSG said. It advises FBOs to plan to add SAF to inventory as more aircraft operators adopt the alternative fuel.

Industry Challenges

FBOs identified five top concerns for their industry, according to the ABSG survey:

- Staffing shortages: In a tight labor market, hiring and retaining employees are more difficult.

- Managing fuel margins: Contract fuel suppliers and fuel programs put pressure on FBOs’ margins.

- Higher operational costs, such as insurance premiums, wages, credit card management.

- Rising airport fees and taxes.

- Environmental legislation and the political landscape.

John Enticknap and Ron Jackson of Aviation Business Strategies Group write the AC-U-KWIK FBO Connection blog and newsletter, which provide best practices and advice to owners and managers of FBOs.