By John L. Enticknap and Ron R. Jackson, Principals, Aviation Business Strategies Group

The 2015 NBAA Business Aviation Convention & Exhibition is now in the books, so let's break down the show from an FBO perspective.

With more than 27,000 attendees and over 1100 exhibitors, the show was very lively, and most FBOs exhibiting said they were pleased by the amount of traffic and activity at their booth. In general, the atmosphere was upbeat with several OEM airframe manufacturers introducing new aircraft and reporting healthy orders to help fill their delivery slots going forward.

The one lament that FBOs seemed to repeat was that business jet operators continue to tanker fuel from their home base resulting in only courtesy fuel buys.

As in the past, many look with anticipation to hearing the results of Honeywell Aerospace's Annual Global Business Aviation Outlook, which is traditionally released at the annual NBAA show. Here's a look at some relevant predictions.

First of all, Honeywell states that “as a slow-growth economic environment takes hold across many global markets, the business aviation industry is not immune to its impact."

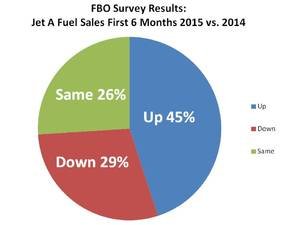

In past blogs, we've talked about the slow-growing economy and our Annual FBO Fuel Sales Survey backs up this statement. We are seeing some bright spots in select markets while fuel sales continue to grow at a slow pace.

As for new business jet deliveries going forward, Honeywell forecasts up to 9200 new business jet deliveries worth $270 billion over the next 10 years. This is actually a downgrade of 3 to 5 percent over the value noted in its 2014 forecast.

The reason we look at new business jet deliveries is that it's a leading indicator of the need by business jet operators either to replace or upgrade their existing aircraft or to expand their current uplift capability.

Another indicator we watch closely is the used jet market to see if inventories have risen or diminished. This gives us another barometer with which to measure and monitor the current health of the business jet industry.

Honeywell's findings indicate a used business jet market that has stabilized at 10 percent of the existing fleet up for resale, which is significantly down from the 16 percent high-water mark recorded in 2009.

According to Honeywell, operators responding to their survey increased their used jet acquisition plans by about 4 points, equating to 32 percent of their fleets in the next five years. For FBOs/MROs who specialize in avionics and cabin upgrades, this is good news.

Other key global findings in the 2015 Honeywell outlook include:

- Operators surveyed plan to make new jet purchases equivalent to about 22 percent of their fleets over the next five years as replacements or additions to their current fleet.

- Of the total new business jet purchase plans, 19 percent are intended to occur by the end of 2016, while 17 and 20 percent are scheduled for 2017 and 2018, respectively.

- Operators continue to focus on larger-cabin aircraft classes, ranging from super mid-size through ultra-long-range and business liner, which are expected to account for more than 80 percent of all expenditures on new business jets in the near term.

- The longer-range forecast through 2025 projects a 3 percent average annual growth rate despite the relatively flat near-term outlook as new models and improved economic performance contribute to industry growth.

As we have written previously, the business jet market and the FBO industry is operating in what we are calling a new normal where the U.S. business economy is slowly growing. Increased tankering of jet A fuel by medium and large business jet operators is also part of the new normal. We have heard from Fortune 500 corporate aircraft operators that they tanker up to 70 percent of their fuel from their own corporate tank farm.

Therefore, it's important for FBO operators to provide excellent customer service in order to enhance and increase fuel sales at the point of transaction. FBOs should also look at ways to increase and diversify potential revenue streams in order to garner a greater share of the customer wallet. We will have more on this topic in future blog discussions.

If you attended NBAA, please give us your perspective in the comment section below.

About the bloggers:

John Enticknap has more than 35 years of aviation fueling and FBO services industry experience. Ron Jackson is co-founder of Aviation Business Strategies Group and president of The Jackson Group, a PR agency specializing in FBO marketing and customer service training. Visit the biography page or absggroup.com for more background.

Subscribe:

Subscribe to the AC-U-KWIK FBO Connection Newsletter