Four Tips to Retain Good FBO Employees

/Employee recognition and retention: What gets rewarded gets repeated

By John L. Enticknap and Ron R. Jackson, Principals, Aviation Business Strategies Group

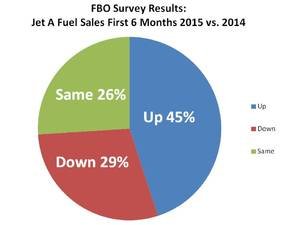

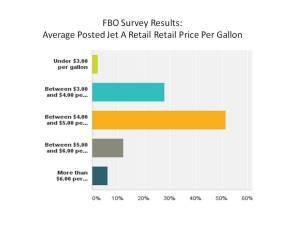

In our last blog, we mentioned that one of the top concerns for FBOs in our Mid-Year Fuel Sales Survey was finding and keeping qualified employees. Needless to say, it's a lot easier to retain a good employee than to go out and find a replacement.

Keeping your valued employees means you have less churn and provides the ability to deliver a more consistent customer service experience.

Keeping your valued employees means you have less churn and provides the ability to deliver a more consistent customer service experience.

Retention of good, qualified employees should rank as a top goal for FBO managers and supervisors along with retention of customers. You should work just as hard to accomplish both.

Here are four tips on retaining good employees:

1. Develop a good internal culture. Make your FBO a rewarding and fun place to work. Internal culture starts at the top. Lead by example.

2. Listen to your employees. Make sure your employees have a voice in your organization. Be appreciative of their input. Invite them to help create your mission, vision and customer promise statements. Employees who feel their voice is being heard will “buy into” the process and help create and maintain a healthy company culture.

3. Treat your employees as stakeholders. A stakeholder is anyone who has a stake in the company in terms of determining success or failure. Besides employees, other stakeholders include customers, vendors and suppliers.

4. Reward the routine. Let’s face it. Many of the tasks performed by FBO employees are repeated numerous times day in and day out. That’s why it is important to let employees know they are doing a good job, even for the most mundane routine task.

On this last point, we’d like to expound a little. By reward we are not talking about money. Research indicates that what most employees seek is being appreciated for a job well done. So let them know. Pat them on the back. Shake their hand. Let them know you appreciate their contribution as a true stakeholder. For example:

”That’s a great job of cleaning the lavatory. Way to go.”

”Super job of marshalling that aircraft. You used crisp and precise hand gestures. Keep it up.”

”You handled that last customer complaint beautifully by taking ownership of that oversight and making it right. Nice job.”

In their book Managing Knock Your Socks Off Service, Chip R. Bell and Ron Zemke state that what gets rewarded gets repeated. If you want your employees to grow with you, yes, they need to be compensated fairly. But what’s more powerful is your recognition, not just for their time on the job, but for their accomplishments as well.

How true. Showing employees you appreciate their contribution completes the retention cycle and helps cement a more permanent stakeholder relationship with the FBO.

What do you do to retain employees? Let us hear from you by making a comment below.

About the bloggers:

John Enticknap has more than 35 years of aviation fueling and FBO services industry experience. Ron Jackson is co-founder of Aviation Business Strategies Group and president of The Jackson Group, a PR agency specializing in FBO marketing and customer service training. Visit the biography page or absggroup.com for more background.

Subscribe: