Part 1: Our FBO Business Outlook for 2012

By John L. Enticknap and Ron R. Jackson, Aviation Business Strategies Group

Get your facts first, then you can distort them as you please. —Mark Twain

Recently we received a call from one of the major business aviation publications asking for our outlook for the FBO business in 2012. As writers, practitioners and consultants to the business aviation community, we are often contacted by the aviation trade press for our views on various industry subjects.

Recently we received a call from one of the major business aviation publications asking for our outlook for the FBO business in 2012. As writers, practitioners and consultants to the business aviation community, we are often contacted by the aviation trade press for our views on various industry subjects.

We have our ears and eyes glued to the FBO market, and recently completed one of our FBO Success Seminars for the National Air Transportation Association (NATA), so we have a pretty good pulse on the health of the industry.

Looking into the FBO Crystal Ball for 2012

First of all, in today’s political environment—especially with an election year upon us—it’s hard to get a good read on what’s going to happen in 2012 on a national level that will affect our FBO industry either positively or negatively. If you’ve watched any of the debates, you probably think ‘ol Mark Twain hit the nail on the head. You might as well wet your finger and hold it up in the air to see which way the economic wind is going to blow.

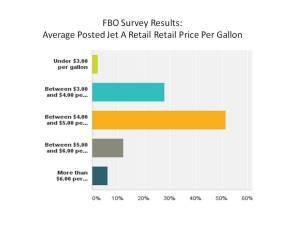

We can start by turning our attention to the cost of fuel because it’s one of the most watched components to running an FBO.

For 2011, the Platt’s (what fuel suppliers use to price Jet A) pricing index at the beginning of the year saw the Gulf Coast Pipeline Mean (GCPM) at $2.4738. By the time December rolled around, the GCPM posting was $2.4866 with the highest price occurring in May, when the GCPM topped out at $3.3239 per gallon. It is interesting to note that in the first week of 2012, the Platt’s index is up a little over 7 cents per gallon.

For 2012 we think it’s fair to say fuel prices are going to remain somewhat volatile and a range of $2.50 to $3.00 per gallon is going to be the norm. With nothing new to report on that front, expect more of the same general course for 2012. (Of course, a caveat is that the world economic situation needs to remain reasonably stable.)

Outlook for FBO Operations

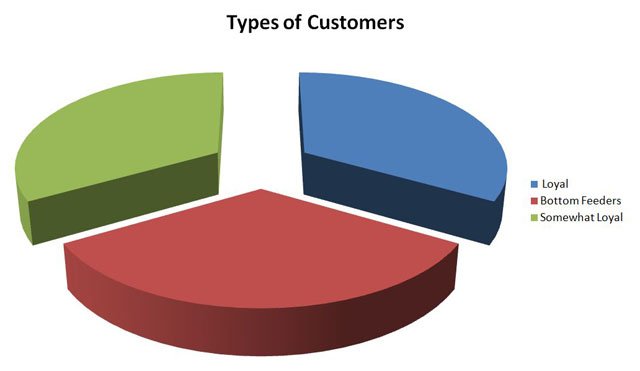

As to actual operations, the best information comes from the FBOs themselves without all the filters from so-called experts. As mentioned, we recently completed another effective FBO Success Seminar in November. We gained a wealth of data from a diverse group of more than 25 attendees representing 20 various sized FBOs.

So what did they have to say?

They all experienced a reasonably stable business environment in 2011 with incremental growth in fuel sales as well as solid aircraft maintenance bookings. If you were to benchmark their growth with the National Gross Domestic Product (GDP) index for 2011, you would see similar numbers to what the attending FBOs experienced, which is a 1.9% increase on average.

Historically, the FBO business suffered significant lows in the 2008/2009 timeframe and since that period has seen small but steady growth. Of course, we’re still seeing some industry fallout from those lean and tough years, so keep in mind FBOs will not be getting back to the 2007/2008 business levels in the near term. This, again, tracks national business trends.

The Market for New Aircraft

Another leading indicator for aviation business recovery is industry forecasts for new business aircraft sales. Traditionally the demand for new aircraft picks up when companies operating business aircraft start to fly more hours and thus feel the need to either replace or expand their current fleet. Obviously, more flying hours equals more airplanes on the ramp equals more fuel sales. So tracking new aircraft bookings is a good idea.

Both Forecast International and Honeywell do not predict business aircraft sales to return to 2008 levels (1,313 units sold) until 2018! However, just for reference, the business aircraft production forecast for 2011 was 683 units with a rise to 728 units for 2012. Again, only a slight uptick, but an incremental increase is better news than a recessionary market.

The companies attending our FBO Success Seminar had similar concerns for the coming new year. They are not expecting anything new or earth-shattering that would help increase business growth.

Other Areas of Concern

Besides a less than robust business environment, the FBO community also has concerns about other areas which might adversely affect their profitability. These concerns include national business trends such as increasing regulations from the EPA and FAA; increasing labor costs including healthcare; and a national election year leading to sustained political gridlock.

In addition, FBOs are concerned about a potential trend of airport boards and authorities getting into the aviation service business and competing against existing firms, or not extending leases with reasonable terms.

So what’s our 2012 FBO business prediction? If your FBO sales increase 5 percent, you are a star! Based upon what the general business trends seem to be, a 2 to 2.5 percent increase would appear to be normal business growth. At the same time, most FBOs will not be adding new employees but instead replacing those lost to attrition. In addition, cost control will remain a high priority as will be increasing productivity. (Stay tuned for Parts 2 and 3 of this series for more on that.)

What about the big FBO networks? In 2011, every chain made some major expansion moves and worked to increase efficiency. (Signature just announced another FBO acquisition as we go to press.) It is reasonable to assume the chains will continue to consolidate the FBO industry. Remember, our national FBO industry includes fewer than 3,000 FBOs while the FBO chains combined represent a group of about 250 locations. Consequently, plenty of acquisition targets remain.

Decrease in Number of FBOs

Another industry trend we should all be concerned about is the continued loss of FBOs within the US. The most recent NATA Fact Book indicated in the year 2009 there were 3,138 FBOs in the US. In November 2010, that number decreased to 2,987. Now, at the end of 2011, there are reports of three more FBOs going out of business and no doubt there will be more to come. Will this be a continuing trend?

As mentioned earlier, there is still fallout from the massive 2008-2009 downturn coupled with the continued unsettled economy. In addition, bank loans have been called, credit has been tightened, leases have not been renewed under reasonable terms, and, to a minor extent, FBO consolidation continues.

Unfortunately, the business pressures FBOs have been under will continue in the coming years and managing a profitable FBO won’t get any easier. However, there are things we can do to affect the bottom line by decreasing costs and increasing productivity. Parts 2 and 3 of this series will discuss these opportunities.

Next in the Series:

Part 2: Decreasing FBO Costs in 2012

Part 3: Increasing FBO Productivity in 2012

Let us know what you think! Please e mail us at jenticknap@bellsouth.net

Ron Jackson

Ron is Co-Founder of ABSG and President of The Jackson Group, a public relations agency specializing in aviation and FBO marketing. He has held management positions with Cessna Aircraft and Bozell Advertising and is the author of Mission Marketing: Creating Brand Value and co-author of Don’t Forget the Cheese! the ultimate FBO Customer Service Experience.

John Enticknap

John founded Aviation Business Strategies Group in 2006 following a distinguished career in aviation fueling and FBO management, including as president of Mercury Air Centers. He is the author of 10 Steps to Building a Profitable FBO and developed NATA’s acclaimed FBO Success Seminar Series.