Bluebook Perspectives: Facing the Nation

/Vol. 25, No. 4 | December 7, 2012 | Go to Charts

IN THIS ISSUE

Bluebook Perspectives: Facing the Nation

Into the Blue: Aircraft Bluebook At-a-Glance, Cessna 152 Series

Ask Aircraft Bluebook: In the aircraft base average lines in the Bluebook we always see the “No Damage History” as a standard requirement, but if there is damage how does the Bluebook reflect this in terms of value?

[Download the full Winter 2012 Marketline Newsletter and All Charts.]

BLUEBOOK PERSPECTIVES:

Facing the Nation

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

It is all said and done. A new leader has been chosen. The challenges of this executive office are staggering. Creating jobs for the people in his charge, modification of the healthcare system and ongoing issues with a slowing economy are enormous.

It is all said and done. A new leader has been chosen. The challenges of this executive office are staggering. Creating jobs for the people in his charge, modification of the healthcare system and ongoing issues with a slowing economy are enormous.

Yes, the newly appointed leader of the People’s Republic of China, Xi Jinping, faces many complex challenges in the days ahead. Similar to President Barack Obama, how policies will be developed to benefit his countrymen have yet to be revealed. One thing is certain, China is focused on growing its economy, so much so that it is predicted to surpass the U.S. economy in less than five years – or so critics think.

Having visited Savannah, Georgia recently, one would see a boom town of growth. Construction is everywhere around the Gulfstream campus. So, if there are such great opportunities to sell aircraft, why aren’t prices more stable these days? I suggest prices are stable, with the exception of Hawker aircraft, for reasons already clear to the aviation community. OEMs are selling new aircraft and making money.

Dealing with the pre-owned market is a bit more challenging. The pre-owned market is being re-defined by the velocity of transactions. It takes more than just a few transactions to make the pre-owned market move in the right direction. Price is always a concern. Sellers want maximum return on their assets. Buyers want compensation for future values up front — in the form of discounts. Similar to the way politics are supposed to work, somewhere in the middle, at least in the playing field of a deal, a resolution is made and a sale is complete. Both buyer and seller may not be happy, but the best outcome was agreed upon by both parties, while the old adage of economics; supply and demand referee. When it comes to the bottom line, the question should be: was the business tool, the corporate aircraft, a needed asset in growing profits by its ability to move folks in an efficient and timely manner? The answer will always be “yes.” Walking around sock-footed and beltless takes time- and time is money. Sure, things could be better, corporations could become more confident in the economy and make some capital investments in their transportation budget, and a legislative agenda for growing the economy could be revealed by President Obama. But none of that looks like it’s going to happen any time soon. One can always hope for better times, but don’t neglect the opportunities that are still available now.

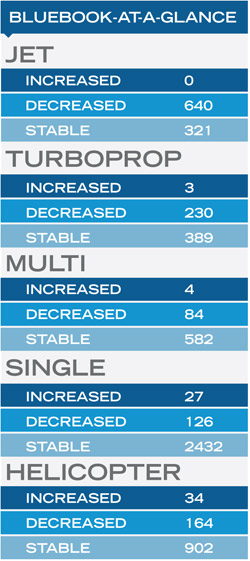

Looking at the BLUEBOOK-AT-A-GLANCE column (page 1) shows a market in motion. Prices for pre-owned aircraft continue to decrease quarter-to-quarter in the jet and turboprop category. Days on market for properly priced aircraft are moving on to new owners in a matter of months. Movement is good.

Fixed wing single and multi engine values remain stable, while the helicopter segment also is reporting a majority of models with no change in values, when compared to the previous quarter. To see what changes have occurred in values, refer to the newly released edition of Aircraft Bluebook – Price Digest®.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.