YTD Pre-owned Transactions & Prices Continue Down

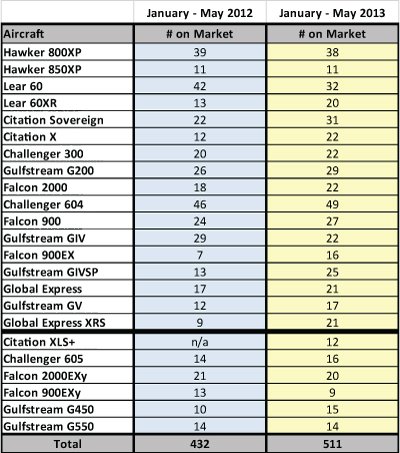

/When viewing a random selection of pre-owned transactions for the first 5-months of 2013, the number of sales are trending down 15 percent when compared to the same period in 2012. Actual selling prices also are down on average 15 percent, while inventory levels for the same group of business jets has increased 20 percent.

As you consider these facts we must also take into account other mitigating factors, such as the year of manufacture of the aircraft sold, cost of the aircraft when it was new, the cost new today, as well as nominal depreciation, et al. By way of example, an aircraft that sold new in 2005 for $44 million and today sells for $32 million is not too far off of a 4 percent per year depreciation schedule. From another perspective, it has retained 73 percent of its original cost , which falls in line with a 30-year useful life.

A number of factors continue to affect growth and stability in our industry – some are geopolitical, others are related to the global financial debacle that started in 2008.

Within our industry, where 250 aircraft were once considered a standard production run, we now have 400+ that will eventually compete in the pre-owned market. Therein in the case of ‘over-production’, we face dynamics that were once not a factor, such as eroding residual values. As the business jet fleet ages and pre-owned inventory increases, will pricing continue to erode? What effect will new aircraft pricing and shorter delivery times have on the pre-owned market?