BLUEBOOK PERSPECTIVES

/Thumps & Bumps in the Pre-Owned Market

Vol. 25, No. 2 | June 6, 2012 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Optimists see the silver lining behind the cloud while the pessimist only sees the cloud. Optimism continues to be the silver lining in the pre-owned aircraft market. However, reality of the dark cloud dictates an awareness and calculated approach.

Such are the conditions in the current ever-evolving pre-owned market. For the most part, the glory days of aircraft values being treated as premium investment opportunities are now nothing more than a faded memory. Knowledgeable buyers and sellers are keenly aware of this. Change of ownership continues at a slow to steady pace while values for the most part show continued depreciation. The exceptions are late model long range executive business jets.

So, why haven’t values had some sort of rally? The answer still remains in the old school of supply and demand. While inventories for pre-owned aircraft are continuing to deflate ever so slightly, the abundance of low time, well maintained business aircraft available in the open market have an economic impact on what the market will bear on any given aircraft sale price. Throw in more financial regulations on behalf of the lender and the result is a not-so-much-room to rally premium sale prices.

Other economic indicators are pointing to limited domestic growth in the near future. Some predictions include another recession in the coming months, concerns for Homeland Security and the impact it will have on corporate aviation along with the cost of energy (fuel). While all of this is really pessimistic, the reality still remains that this is the environment the pre-owned business aircraft market operates in. It’s our bubble inside the big bubble, so to speak.

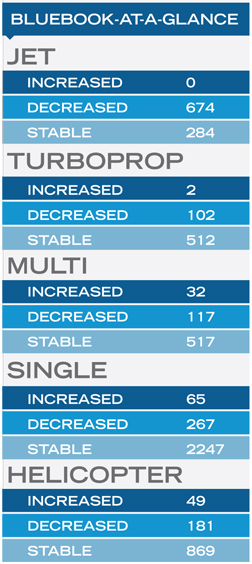

The marquis referencing Bluebook-at-a-glance changes on the right is the reality of an average pre-owned market. For machinery and equipment, which aircraft are classified as, depreciation is the norm rather than the exception. For whatever the cause, the effects are recorded as +/- in the average retail column as it relates to the previous (Spring 2012) values of Aircraft Bluebook – Price Digest. In this market, it is important to remember that transactions between buyers and sellers are more important than actual values. Without movement, there is no market.

In the Jet category, there were no aircraft that increased in average retail value in the Bluebook. Most of the decreases were a reflection of weaker sold prices reported. A number of jets did remain unchanged. Most were in the long range late model class of jets.

For the Turboprop category, the 2006 & 2007 King Air C90GT reported modest increases in average retail. For the most part, values remained unchanged. Decreases in reported average retail in this category were merely another reflection of market activity when compared to the previous quarter.

Much was the same for the Multi and Single piston category. Increases in retail value were reported to include legacy models, those manufactured in the 20th century. Stability in pricing when compared to the previous quarter dominated these market segments.

In the Helicopter category, most models remained stable. Component life and condition play a major role in sale prices. Helicopters that reported an increase in average retail included the Eurocopter AS350 series. For the most part, values were unchanged when compared to the previous quarter.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

[Go to Charts.]

[Download or print PDF of this article and All Charts.]

Such are the conditions in the current ever-evolving pre-owned market. For the most part, the glory days of aircraft values being treated as premium investment opportunities are now nothing more than a faded memory. Knowledgeable buyers and sellers are keenly aware of this. Change of ownership continues at a slow to steady pace while values for the most part show continued depreciation. The exceptions are late model long range executive business jets.

So, why haven’t values had some sort of rally? The answer still remains in the old school of supply and demand. While inventories for pre-owned aircraft are continuing to deflate ever so slightly, the abundance of low time, well maintained business aircraft available in the open market have an economic impact on what the market will bear on any given aircraft sale price. Throw in more financial regulations on behalf of the lender and the result is a not-so-much-room to rally premium sale prices.

Other economic indicators are pointing to limited domestic growth in the near future. Some predictions include another recession in the coming months, concerns for Homeland Security and the impact it will have on corporate aviation along with the cost of energy (fuel). While all of this is really pessimistic, the reality still remains that this is the environment the pre-owned business aircraft market operates in. It’s our bubble inside the big bubble, so to speak.

The marquis referencing Bluebook-at-a-glance changes on the right is the reality of an average pre-owned market. For machinery and equipment, which aircraft are classified as, depreciation is the norm rather than the exception. For whatever the cause, the effects are recorded as +/- in the average retail column as it relates to the previous (Spring 2012) values of Aircraft Bluebook – Price Digest. In this market, it is important to remember that transactions between buyers and sellers are more important than actual values. Without movement, there is no market.

In the Jet category, there were no aircraft that increased in average retail value in the Bluebook. Most of the decreases were a reflection of weaker sold prices reported. A number of jets did remain unchanged. Most were in the long range late model class of jets.

For the Turboprop category, the 2006 & 2007 King Air C90GT reported modest increases in average retail. For the most part, values remained unchanged. Decreases in reported average retail in this category were merely another reflection of market activity when compared to the previous quarter.

Much was the same for the Multi and Single piston category. Increases in retail value were reported to include legacy models, those manufactured in the 20th century. Stability in pricing when compared to the previous quarter dominated these market segments.

In the Helicopter category, most models remained stable. Component life and condition play a major role in sale prices. Helicopters that reported an increase in average retail included the Eurocopter AS350 series. For the most part, values were unchanged when compared to the previous quarter.