FBO Industry Forecast: Brace for a Slow but Positive Recovery into 2022

/As the effects of the COVID-19 pandemic on the U.S. and world economies begin to wane, the FBO industry is bracing for a slow but positive recovery.

This is part of our FBO industry forecast for the next three quarters and into the first part of 2022. Our forecast, threaded below, is based on our Annual FBO Fuel Sales Survey, interviews with FBO owners and aircraft operators, analysis of the oil markets and the aviation fuel industry.

- FBO Operators Indicate a Slow but Positive Recovery for 2021

With a record high of 67% of survey respondents indicating they had a decrease in fuel

sales in 2020 compared  to 2019, it is hard for the industry to be optimistic moving forward. Yet, when we asked FBO operators to predict fuel sales for 2021 vs 2020, we had some surprising results.

to 2019, it is hard for the industry to be optimistic moving forward. Yet, when we asked FBO operators to predict fuel sales for 2021 vs 2020, we had some surprising results.

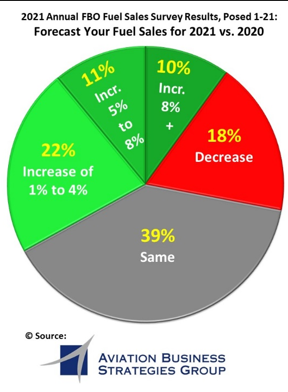

Only 18% expect fuel sales to decline while 39% said they expect to have at least the same fuel sales in 2020.

That leaves 43% predicting increased fuel sales for 2021. Here’s is how the percentages break down:

-- 22% said they forecast fuel sales increases of 1% to 4%

-- 11% said they forecast fuel sales increases of 5% to 8%

-- 10% expect to have fuels sales exceed 8%

- Increased Oil Prices

With WTI passing the $60 per barrel mark we look for oil prices to continue to fluctuate and approach $70 a barrel as oil markets tighten, U.S. oil production stagnates and consumer demand begins to outstrip production.

- Prepare for Inflationary Trends

With fuel prices on the rise, the cost of moving consumer and staple goods will increase due to higher transportation costs and other inflationary pressures. We look to see inflation gradually increase and could easily exceed 3% and approach 4% before the year is out.

- FBO Industry Consolidation

With the pending sale of the Atlantic Aviation FBO Chain, look for some of the Atlantic branded FBOs to be sold separately should an existing FBO chain get involved in the purchase, thus forcing divestiture of same-field duplicate facilities. Some smaller and emerging chains continue to add FBOs sporadically through the acquisition process.

- Jet A Fuel Prices and SAF

Jet A fuel prices will be irregular for most of the year and will generally follow the price of oil as in the past. FBOs will need to be mindful of what is in their inventory and adjust their fuel margins regularly. Also, Sustainable Alternative Fuel (SAF) is here to stay, so plan to add this fuel to your inventory as demand from aircraft operators increases.

- Trend: FBO Selection Based on Safety and Health Standards

In the present and post Covid-19 environment, aircraft operators, particularly those flying internationally, will become more selective in choosing FBO service providers in favor of those with a minimum of at least a safety management system (SMS) and/or an IS-BAH registration designation. This is due in part to perceived health and safety measures that FBOs are either adopting or have in place.

- Trend: Increased Business Flight Activity

Look for business aviation flight activity for North America to steadily increase throughout the rest of 2021. According to March TraqPak data from Argus International, business flight activity grew 46% year-over-year logging 266,585 flights which was slightly more than recorded in pre-pandemic March of 2019.

Please leave any comments you have about this blog post below. If you have any questions, please give us a call or send us an email: jenticknap@bellsouth.net, 404-867-5518; ronjacksongroup@gmail.com, 972-979-6566.

ABOUT THE BLOGGERS: John Enticknap has more than 35 years of aviation fueling and FBO services industry experience and is an IS-BAH Accredited auditor. Ron Jackson is co-founder of Aviation Business Strategies Group and president of The Jackson Group, a PR agency specializing in FBO marketing and customer service training. Visit the biography page or absggroup.com for more background.

SUBSCRIBE:

Subscribe to the AC-U-KWIK FBO Connection Newsletter

© 2021 ABSG